Senior Accountant

Coast Community HEalth Center

Position

- Title: Senior Accountant (Pathway to CFO)

- Organization: Coast Community Health Center

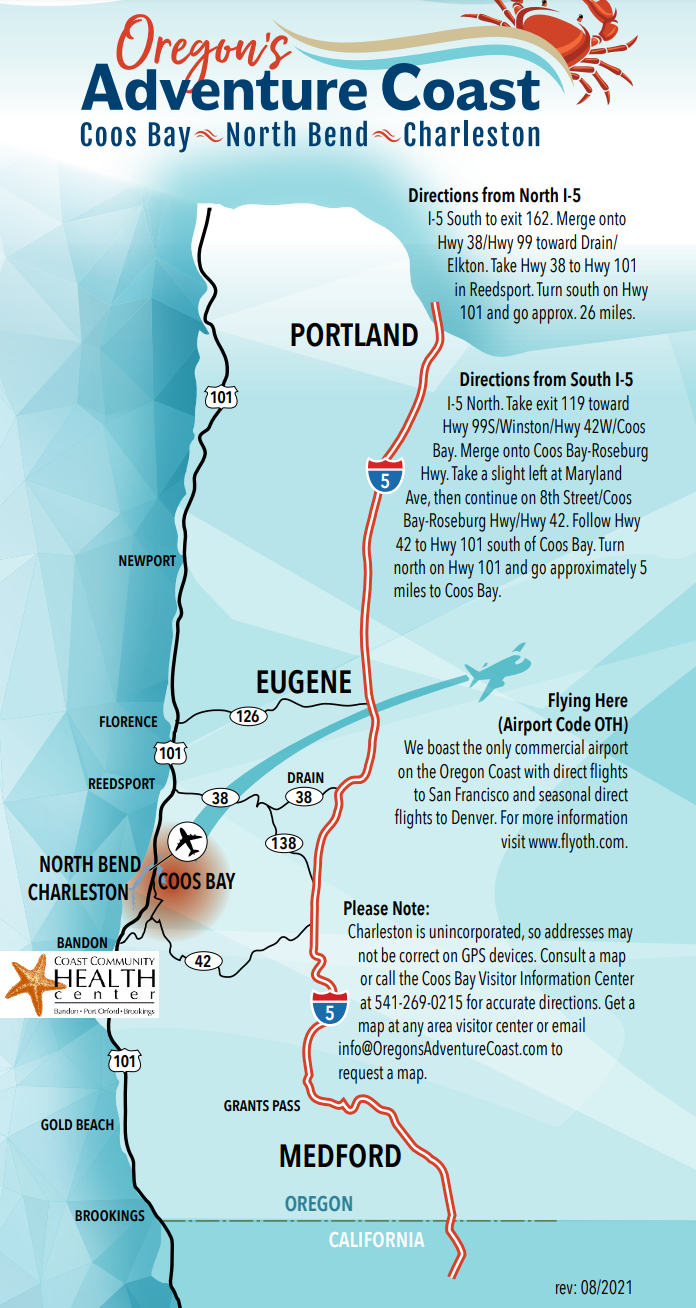

- Location: Bandon, OR (Oregon Coast / Coos Bay Area)

Contact

David Haasch

Managing Dirfector

(208) 810-4423

david@centermarkplacements.com

Overview

Our firm has been retained by Coast Community Health Center to lead the search for the organization’s next Senior Accountant

Learn More

Beautiful, coastal living with direct flights to San Francisco and only a 1.5 hours drive to Eugene and the I-5 Corridor

The Company

- Growing, mission-driven healthcare organization that provides care to everyone in the community regardless of their ability to pay. Services include Primary Care, Dental, Behavioral Health, and Pharmacy

- Established as a 501(c)(3) non-profit, Federally Qualified Health Center, the organization provides care to approximately 5,000 patients with an operating budget of $8M

- Organization is in a strong financial position with expansion plans that include opening a new health center, adding new service lines, and expanding behavioral health which has doubled in volume over the past two years

Live and work on the Oregon Coast!

Visitor’s Guide

Learn more about “Oregon’s Adventure Coast” by visiting the information guide at www.oregonsadventurecoast.com

4 Wheel Recreation

The Oregon Dunes National Recreation Area is the largest expanse of coastal sand dunes in North America extending for 40 miles along the coast and has dunes that tower more than 500 feet above sea level

Amazing Fishing

When it comes to fishing in Oregon, opportunities are in no short supply – especially here on Oregon’s Adventure Coast! There are fish for every season and an endless choice of prime fishing spots to select from

Cycling

Whether you take to the road, fat bike on the beach, or careen around single-track trails, you will find heart pumping options on Oregon’s Adventure Coast

Undeveloped Beaches

Miles and miles of beautiful, undeveloped beaches may be one of the areas greatest natural assets. The beaches on Oregon’s South Coast are ideal for anyone searching for a quiet, undisturbed spot to watch the tide roll in and out. They are also perfect for those looking for a place to surf, swim, walk the dogs or search for hidden beach treasures

World Class Golf

Bandon is home of the world famous, Bandon Dunes Golf Resort, one of the country’s largest and most popular golf retreats!

Benefits and Features

- Competitive compensation and benefits including paid relocation

- Report to the new CEO of an $8M Federally Qualified Health Center

- Excellent opportunity for a finance leader with FQHC experience who would like to grow into a CFO over time

- Growing organization that is opening new locations and expand services in the community

- Work for a mission-driven organization that was founded by members of the community to meet the healthcare needs of the underserved in the region

- Organization values visionary thinking and is receptive to creative solutions to improve operations in service to the patients and community. Prepare the organization for future growth opportunities and strategies to stay on the cutting edge of healthcare

- Supportive Board will provide the CEO the latitude and resources necessary for success

- Play a key role in the continued optimization of the revenue cycle. The organization has a new outsourced billing partner and a recently implemented EPIC system

- Live and work where others vacation! Endless outdoor recreation opportunities to enjoy your time outside of work

- Coos Bay Airport has regular, direct flights to San Francisco and Eugene/I-5 Corridor is just 1.5 hours away. It's easy to travel when you need to

Background Profile

- 5+ years of accounting experience in a Federally Qualified Health Center is required. 3+ years of management experience is desirable

- Bachelor’s Degree in accounting, Finance, or related field is required. MBA or Master’s in Accounting preferred. CPA is valuable

- Demonstrated, hands-on skills and experience in preparation of cash flow analyses and budget variance analyses

- Proficiency in Quick Books, Sage Software, Excel and other Microsoft applications

- Revenue Cycle experience to partner with the outsourced billing provider is valued

Job Description

- Prepares, reviews, and ensures accuracy of financial records and transactions, identifies and researches discrepancies, resolves or makes recommendations for corrective actions, creates audit reports, and works with external auditors to support annual audit process.

- Reconciles identified discrepancies with regard to journal and accounting transactions, reviews, research, and analyzes reporting errors, creates reports and compiles supporting documents for corrections within accounting systems, and guides management through corrective actions.

- In conjunction with the Chief Financial Officer, assures the timely and accurate preparation of financial reports and assures that the reports reliably reflect the financial position of the health center.

- Monitors and tracks expenditures and revenues, analyzes financial performance, prepares financial reports, forecasts expenditures, guides management in fiscal compliance and analytical planning, and anticipates potential problems.

- Manages specific contracts/accounts and related accounts payable; reviews and approves certain invoices for payment (or ensures managers are properly reviewing and approving invoices), ensures contract rates and terms are accurate, prepares journal vouchers, and creates and maintains account spreadsheets.

- Prepares customized accounting reports, spreadsheets, and financial statements from the electronic health record (EHR system) for integration and record keeping within the financial software and for monthly financial metrics reporting.

- Research and compile data and reports on financial data for CFO and other executive management, creates quarterly and annual reports as required, and assists CFO and executive management with data submissions and compliance reporting.

- Works with CFO and executive management as point of contact to respond to inquiries from internal and external stakeholders.

- Ensures compliance and maintains fiscal accountability for rules, regulations, standards, policies, and procedures in accordance with accounting principles.

- Responsible for preparation, direction and/or submission on a timely basis all financial data associated reports required by government and other regulated agencies including but not limited to, payroll tax reports, public disclosure reports and third-party payor cost reports.

- Directs the preparation of internal financial reports including work papers for annual financial audit.

- Complete special projects and reports, as requested by the CFO.

- Collaborates closely with the CFO to develop annual operational, capital, and federal budgets that support the organization’s long and short-range plans and objectives and reflects the board approved strategic plan.

- Recommends budget modifications as required. Assists managers in the development of departmental budgets.

- Identifies and reports undesirable trends and potential business opportunities and makes recommendations for action. Assumes a supportive role to the CFO in analyzing and exploring means of reducing the organization’s operating costs and increasing revenues based on knowledge of market trends, financial reports, and operating procedures. Payroll Processing & Reporting

- Provides oversight to payroll controls and processing, year start-up deduction controls, internal audit, payroll processing batch notes, verifications of deductions, communication with human, garnishment processing, review of payroll batch submission, transmission of payroll processing,

- Update’s payroll records for changes for staff information, pay rates, benefits, and reconciles benefit invoices to payroll records monthly to ensure all benefit invoices are accurate etc.

- Responsible for Transmission of payroll file on a timely basis, review Payroll Tax and Summary reports monthly, quarterly, and annual reporting

- Ensures payroll bank funding; verifies funds are in the operating account for payroll and payroll taxes.

- Reviews Quarterly tax reports and EFT payments.

- Prepares year end 1099 timely, review W-2’s processed by payroll company for accuracy. Revenue Cycle Management

- Responsible for the daily posting and reporting of revenue.

- Collaborates closely with the CFO and executive management on health insurance contracts, contract payments, revenue review, subcontracts, and associated credentialing of medical providers for management of revenue generation

- Administers the general accounting associated with patient revenue, sliding fee, bad debt write-off, contractual write off third-party reimbursement, prepares financial, and statistical reporting of the health center revenue including but not limited to provider encounter and coding reports, patient class and assignment data, other revenue related reports, in accordance with established policies and accounting procedures. Grant Funding Tracking & Reporting

- Responsible for the management of grant processes including, but not limited to: grant tracking set-up and expense reporting; reviews grant awards and terms for financial impacts, audits grant records and transactions, researches and analyzes expenditures and revenues, creates quarterly and annual grant reports, and closes out grants within financial systems.

- Responsible for the monthly processing for drawdowns or invoicing of federal, state and other grant accounts.

- Responsible for grant budget creation, following guidelines established by funding sources, to allow for approval and spend down of all awarded funds. Back-up Payroll Process & Payable Cycle Processing

- Requires close collaboration with accounting team with Accounting Coordinator to ensure back-up coverage for processing of payroll and accounts payable processing, including but not limited to payroll processing, time & attendance processing, payroll input (new employee payroll entry), and (employee payroll updates), final paycheck processing, and payroll batch processing.

- Accounts payable processing, including but not limited to payable entry, ACH, direct payment, and hard check processing for vendor payables, complete payable processing, including invoice approvals, entry set up for new vendors, payable processing in SAGE software systems.

- Trains subordinates on the above areas and monitors performance to ensure fiscal responsibilities are fulfilled.

- Assists the CFO and executive management in the development of long and short-range organizational plans that may include service demand analyses, resources availability analyses and cost benefit analyses of proposed capital and staff expansions.

Learn More

Candidate Testimonial

Watch a testimonial to hear from a recent candidate who shared what it was like to be recruited by Centermark Placements.

- Found a position that was the "perfect fit" for the candidate

- Candidate states they felt like a "complete VIP”

- Better opportunity that was closer to home with pay commensurate with her 20 years of experience